January No Spending Month In Review Tiny Adventures

Kickstarting the new year with a no-spend January can help you take control of your finances, especially if you have a pile of post-Christmas credit card debt. But it can work in any month of the year where you may need to go that extra mile to cut your costs or save up more. So, I spend Well, you make the rules about your no-spend month.

Pin on

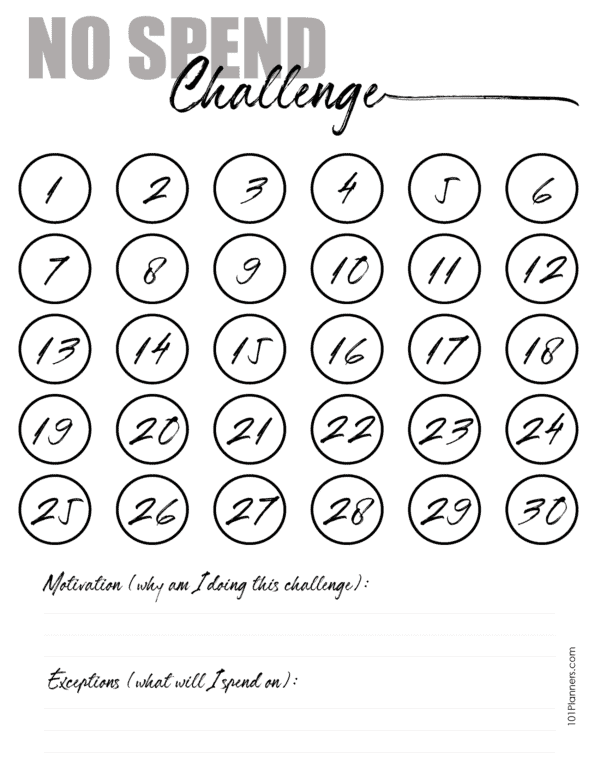

Here are six great tips to start your no-spend month: 1. Figure out your motivations and goals for the month. Saving money for the sake of saving doesn't work for most of us. So get clear on why you want to do a no-spend month before you start. Ideally, write it down somewhere, and get specific.

No Spend Month Tips & Tricks Saving & Simplicity

A no-spend month is a challenge where you don't spend money on anything for a month except the essentials. That means covering what we call your Four Walls (food, utilities, shelter and transportation) and basically nothing else. No eating out, no spending on entertainment, no new unnecessary gadgets—zip, zilch, nada.

How No Spending Month Challenges Can Reduce Stress Month challenges, No spending month, Reduce

By Geoff Williams | Sept. 9, 2021, at 12:26 p.m. A no-spend challenge can be fun if you do it with friends and have some support. (Getty Images) If you went on a serious spending spree this.

UPDATE! October is another “No Spending Month” Organised Life and Mind

In a nutshell, a no spend month is accomplished by only spending on necessities for a month. Necessities would include things such as: bills gas insurance food (milk, produce and perishables are priority) emergency essentials (medical, car/home repair, etc) priority school expenses (lunch, field trips, etc.)

Save Money Doing a NoSpend Challenge

Highlight each item in your budget that's considered "essential," as listed above. Next, simply reallocate all of your other, discretionary budget items to savings. For example, if you normally spend $200 per month eating out, $250 per month on entertainment and $150 per month on miscellaneous shopping, reallocate all of that $600 to your.

No Spending Month Simplify for the Good Life

This will depend on your preferences, but might include: Canned tomatoes. Canned beans (or dry, which are cheaper and have less sodium) Quinoa, couscous. Once you have your bases covered, you can.

No Spend Month Challenge Tips & Printables

The no-spend challenge is a powerful exercise for your wallet and an eye-opening experience to evaluate your relationship with money and possessions. It starts with drawing out a clear line between wants and needs. Food, water, medicine, basic toiletries, and bills are usually classified as needs, and everything outside is considered wants.

No Spending Month Meal Plan January 13th19th Tiny Adventures

What is a no spend month exactly? A no spend month is precisely what it sounds like. It's a savings challenge where you commit to only spending money on the necessities for a whole month. It doesn't mean you are spending nothing at all - which would be quite difficult.

No Spend Challenge Printable Bundle, No Spend Month Challenge, No Spend Ideas for FamiliesSize

What is a No-Spend Month? A no-spend month challenge is testing yourself not to spend any money on non-essentials for one month. You cut out all your unnecessary expenses and live frugally. The rule of the no-spend month is that you must only spend money on things that you need for one month.

Pin on Printables

A no spend challenge, or spending freeze, is a timeframe, such as a day, week, or even month, in which you challenge yourself to stop spending money on things that are unnecessary. No spend challenges have become quite popular over the last few years and are a great way to save a lot of money in a short period of time.

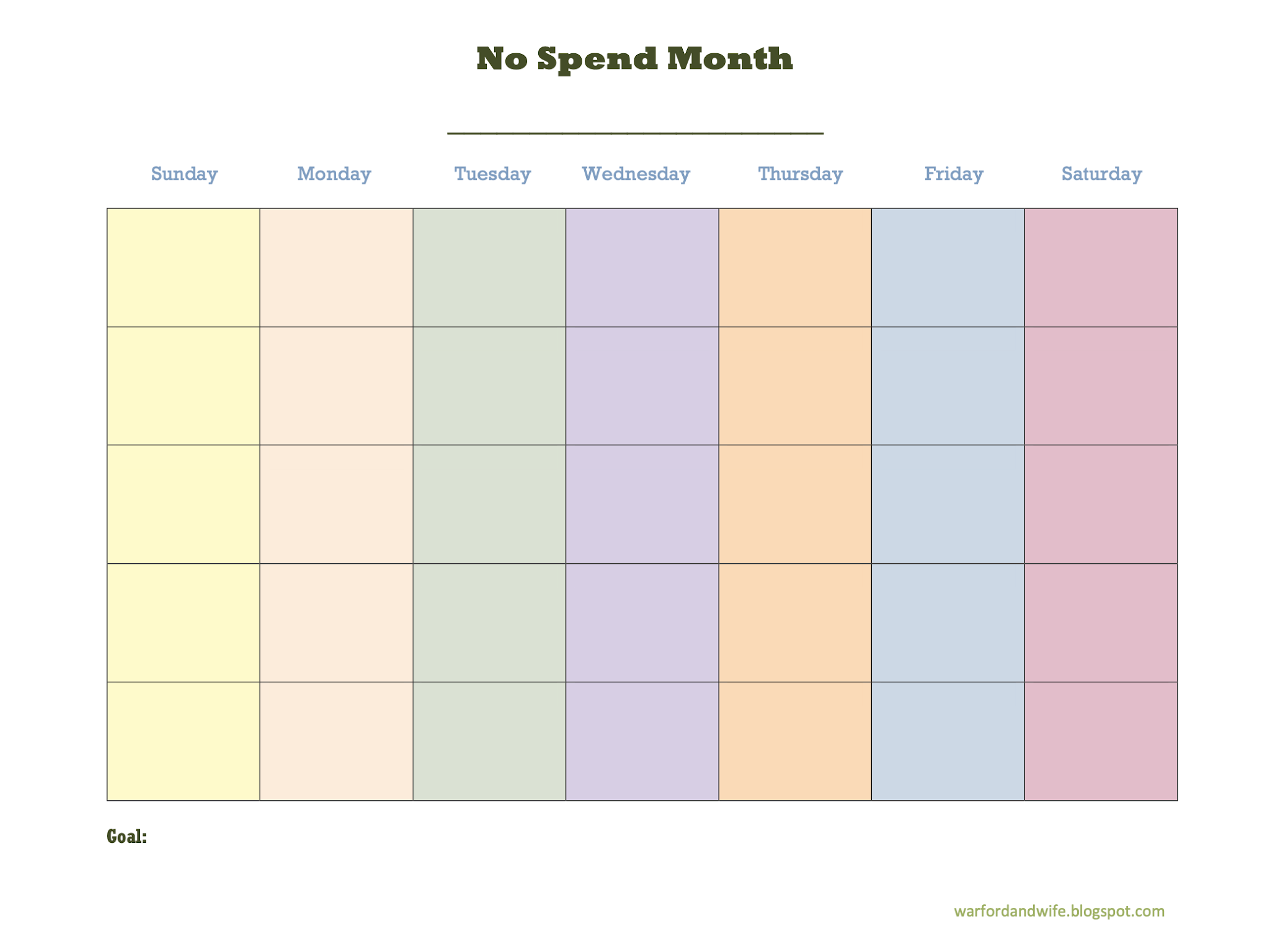

Planning a NoSpend Month Six Figures Under

The concept of practicing a no-spend month is to take a complete month-long break from your usual spending habits other than important essentials like food and housing costs. In the process, you'll be able to rack up a fairly significant amount of cash savings that you can put in the bank.

Freeze Your Spending A StepbyStep Guide to Complete a NoSpend Month Challenge!

The idea of a no-spend month couldn't be simpler: Don't shell out any money unnecessarily for 30 days. In the process, you save big but also begin to understand your shopping tendencies — and which situations make you feel a retail urge. Of course, actually completing it is the challenge.

30 Day No Spend Challenge with a Printable Tracker

Museums, parks, football games at the local high school, game night with the family. Keep your mind off of the things you aren't doing and the items you aren't buying and focus on the things in life that don't cost anything at all. Reward yourself. At the end of your no-spend challenge, reward yourself. Catch a movie with a friend and.

EagleSoaringHigher 96. What do you think of a NO SPENDING month?

What is a no-spend month anyway? A no-spend month is a period of one month in which you ban spending. It's something you decide to do yourself (for various reasons). You are no longer allowed to spend money on anything that is not a necessity. Simple! Not easy, but simple. What do we mean by NO spending? Like… at all?

No Spend Month How It Works (and a printable!)

1. Time It Right A financial fast is a terrible idea around the holiday season, of course. But also think about your own calendar before you begin. Avoid vacation time—or a month with a lot of birthdays or other special events that would send you running for your wallet. 2. Establish Rules